Retail Reassurance

Plus: This Week's Featured Place: North Platte, Nebraska

source: Visit North Platte

Inside this Issue:

Don’t Start Singing that Recession Song: Retail Sales Still Humming Along

Recession Fears Nevertheless Grow: Stock Market Slaughter Adds to the Woe

Housing Backbone Somewhat Stiffer: But a Few Gloomy Voices Beg to Differ

1970s-style Grief? It’s Not that Bad, Says an Old Fed Chief

Freight Rail Profits Soar: But Railroad Customers Sore

Lake News: Major Western Water Supply Threatened by Drought

Factory Fumes to Hospital Rooms: From Industrial Economy to Care Economy

Car Hopping: The Quest to Develop Flying Cars

And This Week’s Featured Place: North Platte, Nebraska, Trains on the Plains

Quote of the Week

“We can tell you what we saw during the quarter and the start of May, where we just continue to see a resilient consumer. Our traffic numbers are up to start the second quarter.”

-Target CEO Brian Cornell

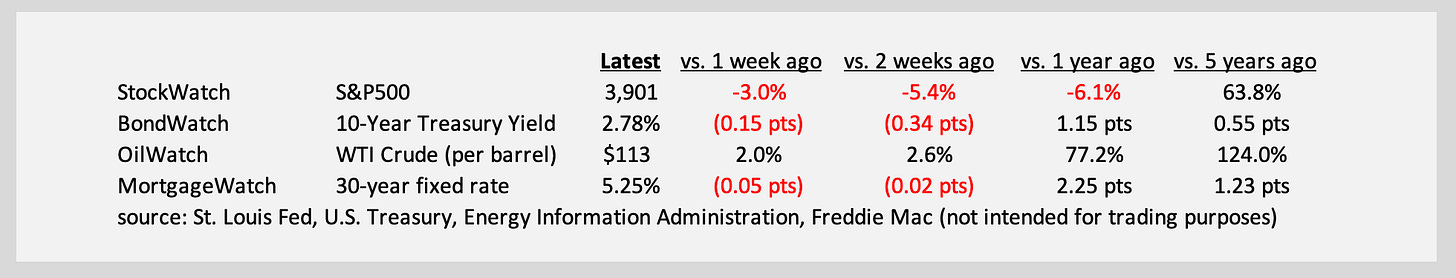

Market QuickLook

The Latest

Uh oh. Walmart and Target, two behemoth retailers, both posted disappointing financial results for the first quarter, hinting that maybe—just maybe—American consumers are tightening their belts. Falling real incomes. A fast-falling stock market. Higher and higher prices for everything. Maybe the spending is ending. Maybe a recession is coming.

Hang on. Headwinds are blowing, for sure. But the first-quarter disorder at Walmart and Target had nothing to do with slumping demand. On the contrary, both said demand was—and continues to be—exceedingly strong. Walmart’s U.S. sales increased 4% y/y. Ditto for Target. Their problems were instead tied to higher costs, notably for labor, fuel and transport. They also bungled their staffing and inventory management, with Walmart over-hiring during the Omicron wave, and both retailers failing to anticipate abruptly changing patterns of consumption. Households allocated more of their money to necessities like food, for example, and more of their money to services like travel. As Target explained, it sold fewer televisions than it expected, but a lot more luggage.

The larger point is that spending in the aggregate continues to hum. Other retailers reporting last week made that abundantly clear. According to Home Depot and Lowe’s, Americans are still spending a lot of money on home improvement. TJX—owner of T.J. Maxx, Marshalls and Home Goods—sounded no less bullish, in its case benefitting as inflation drives consumers to “trade down” to discounted items, and to “trade over” from buying online to buying in-store. The trade down trend, unsurprisingly, seems to be more pronounced among lower income Americans. TJX markets to a broad range of income demographics but said higher-income stores were preforming better, suggesting perhaps some spending weakness at the lower end. The trucking and logistics giant J.B. Hunt, anecdotally, spoke of slowing demand to ship lower-end furniture.

But again, the overall sentiment is upbeat, not least from the sneaker retailer Foot

Keep reading with a 7-day free trial

Subscribe to Econ Weekly to keep reading this post and get 7 days of free access to the full post archives.